Blog Details

Debt Doesn’t Define You: Taking the First Step to Business Freedom

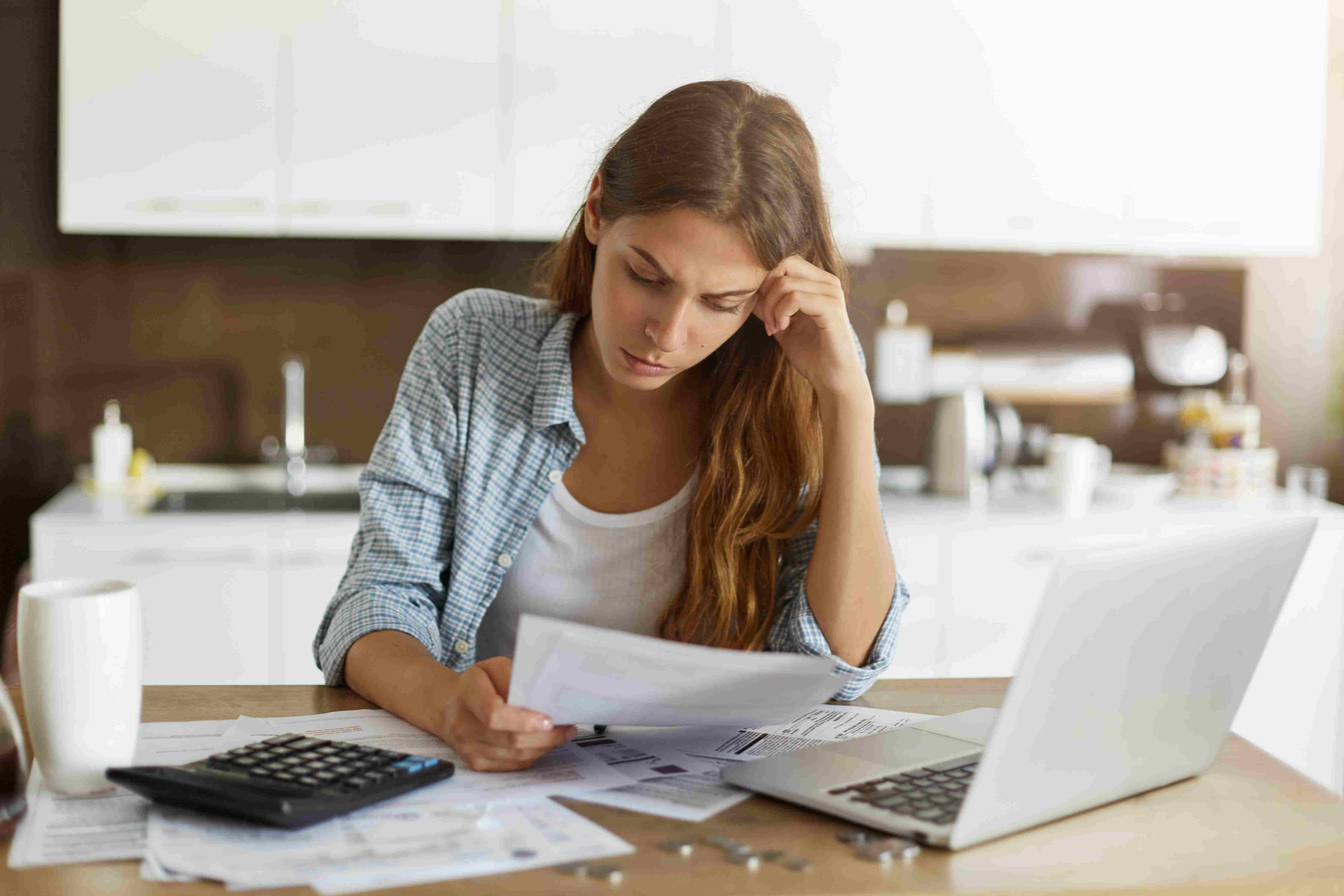

Debt is one of those terms that weighs far more than figures on a balance sheet. For some business owners and entrepreneurs, debt isn't something that appears as a monetary responsibility, it insidiously finds its way into your confidence, your decision-making, and even your self-esteem.

Debt is one of those terms that weighs far more than figures on a balance sheet. For some business owners and entrepreneurs, debt isn't something that appears as a monetary responsibility, it insidiously finds its way into your confidence, your decision-making, and even your self-esteem. But this is the truth: debt doesn't define you. It is merely a circumstance, and not your identity, and definitely not the end of your business.

The journey to freedom starts with recognizing that this mental shift and then taking concrete, brave actions to turn things around, is happening.

Why Debt Feels Personal

When a business struggles with debt, the pressure tightens. Many founders think financial struggles are similar to personal failure. Thoughts like “I’m not good enough to run this business” or “My business doesn’t have any potential to rise again” are common, but they are misleading.

The truth is that debt too often results from forces beyond one's control. Volatile markets, surprise expenses, slow payments from clients, or even fast growth outrun the cash flow. These are problems, not flaws in character. Accepting this difference is the beginning of taking back control.

Step 1: Accept the Reality

Step one on the path to freedom is understanding. Most entrepreneurs will steer clear of considering the complete picture of their debt because it's difficult to deal with. Avoidance only compounds the problem. Instead,

- Make a list of all your debts like loans, credit facilities, vendor bills, tax liabilities.

- Put down the interest rates, payment dates, and amounts outstanding.

- See which debts are pressing and which can be negotiated.

This reframes the issue from a threatening cloud to a map that can help you chart all the liabilities.

Step 2: Redefine Debt as a Business Problem, Not Personal Failure

Once you've got the whole picture, keep in mind: you are not your balance sheet. Debt is a problem much like customer acquisition, hiring, or product development. You wouldn't identify yourself by a short-term marketing failure, so why do it by debt?

Reframing helps you tackle the situation with problem-solving energy instead of shame. Instead of thinking, you’re drowning in debt, think, what strategies will help you restructure and regain stability.

Step 3: Find Relief and Restructuring Options

Freedom from business comes when you break free from letting debt dominate your life and take steps to find solutions. Some practical solutions are:

- Debt Consolidation: Combine many high-interest debts into one simple debt with lower interest rate.

- Negotiation: Most lenders and suppliers are willing to restructure payment terms if you approach them early.

- Professional Debt Relief Services: Experts can restructure payments, lower interest, and provide you some relief.

- Cash Flow Improvements: Go back over pricing, cut unnecessary expenses, and concentrate on money streams that pay back more quickly.

Every small move toward reorganization will reduce the pressure a great deal and restore your sense of control.

Step 4: Create Systems Preventing Recurrence

Real business freedom not only comes from escaping debt, it's creating habits and systems which minimize the risk of returning to debt again.

- Keep business and personal finances separate.

- Use financial forecasting to predict cash deficits before they become crises.

- Automate savings and reserves to create a cushion for slow months.

- Get mentorship or financial coaching. A new set of eyes often finds opportunities that you can't perceive when under pressure.

Freedom isn't about removing all threats, it's about possessing systems that allow you to work around them with resilience.

Step 5: Protect Your Mindset

Debt becomes emotionally draining for not just your business, but your mind. Sleepless nights, anxiety, and burnout can be common symptoms of financial pressure. Take care of your mindset so you can make smart decisions.

- Surround yourself with fellow entrepreneurs who've been through tough times like this.

- Celebrate small wins—don't wait for perfection.

- Keep the "why" in mind—the original vision that brought you to become an entrepreneur in the first place.

When you turn your attention from what you've lost to what you can still create, you gain the strength to go on.

Freedom Is a Process, Not a Quick Solution

Getting out from under debt doesn't occur overnight. But every step—whether it's calling that first creditor, combining a loan, or just putting down your debts on paper—is a step toward freedom.

Your company is greater than its current struggles financially. It is your dream, your determination, your willingness to adapt. Debt is merely one book, not the entire novel.

Debt does not define you. What it is that defines you is having the strength to approach it—and taking the steps to get beyond it.